How can you make payroll as easy as possible? For the 50% of business owners that choose to do payroll themselves, that’s a question worth answering.

Getting it wrong can mean a nasty conversation with the IRS, so you want to know how to pay employees the right way.

Read on to find how you can pay your employees in less time and greater accuracy.

Employee Status and Paydays

The first thing you need to figure out is the status of your employees. Hourly employees may be eligible for overtime while salaried employees usually aren’t.

Are your employees actual employees, or are they contractors? The major difference between the two is that you offer benefits to employees and have more control over things like the hours of work.

You are also responsible for withholding and paying for half of your employees’ social security and Medicare taxes. A contractor is responsible for paying their entire tax responsibility.

You also have to decide when employees get paid, whether that’s weekly, bi-weekly, or monthly.

How Do You Calculate Payroll Taxes?

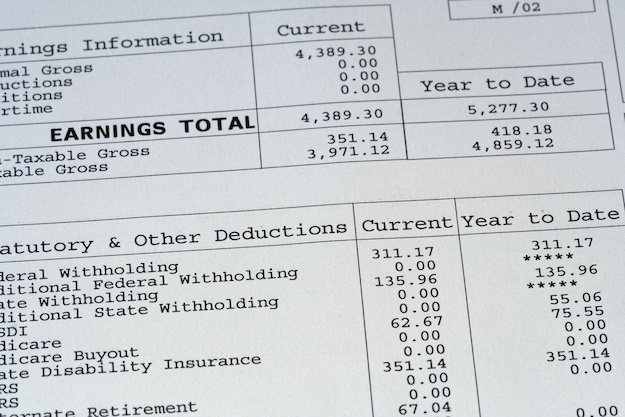

The place that trips up a lot of employers is when they have to withhold taxes. When you learn how to pay employees, this is the first thing to learn. You have to withhold state, local, and federal taxes.

You also have to withhold Social Security and Medicare taxes. For employees who make less than $132,900, that amount is 6.2% for Social Security and 1.45% for Medicare.

Use Accounting Software

You can choose to do your payroll on an Excel spreadsheet. If you want to bring your business into this century, you should upgrade to accounting software.

What accounting software can do that an Excel spreadsheet can’t is automate certain actions so you don’t have to do the same thing over and over again.

There are also accounting solutions that are in the cloud. You can access your payroll software from any device anywhere, so you don’t have to be in the office just to do payroll.

Give Your Employees Paystubs

When you do your payroll, you’ll find that many employees opt for direct deposit. You may not think that you need to provide employees with pay stubs.

Some states require you provide pay stubs to employees. They’re not required under federal law. Your employees will be much happier when you give them paystubs.

Your employees need pay stubs for everyday things. If they plan to move into a new apartment, get a loan, or apply for a home mortgage, they need to show pay stubs as proof of income.

You’re better off giving them to employees as a matter of habit. Some accounting software will let you print paystubs. However, if you’re using Excel for your payroll, you’ll need to use a paycheck stub maker for creating pay stubs.

How to Pay Employees the Easy Way

You may want to avoid doing payroll, but you know you have to keep your employees happy.

You can learn how to pay employees and make the process easier by putting a system in place. Are you ready to get your payroll under control? Check out these payroll systems for your business.