Technology continues to make people’s lives easier and to help us become more informed in many facets of life. It has also allowed consumers to save a lot of money. The finance industry has always been ripe for disruption and it began with online brokers offering much cheaper trading options to the consumer.

Thirty years ago it was not easy to trade stocks and mutual funds. Normally you had to call up a stock broker, pay him or her a hefty fee, and then pay a large fee for any mutual fund that was bought. Now with a few clicks we can trade on our own and avoid most of the costs that used to exist when it came to trading financial investments.

Financial And Retirement Planning

Although it became much easier to manage your own money online, the realm of financial and retirement planning was much slower to change. We still had to call up a financial advisor to have him or her run a complex financial plan for us. The cost of such a plan was normally over $1,500 and we didn’t have access to it. We simply received a 100+ page report from the advisor and it collected dust for the next ten years. Even worse, many financial advisors try to pitch products such as insurance and annuities that we might not even need or want.

But technology knows few limits these days and now there is powerful financial and retirement planning software for the masses. WealthTrace has brought accurate planning software, which is usually reserved for financial advisors, to the consumer.

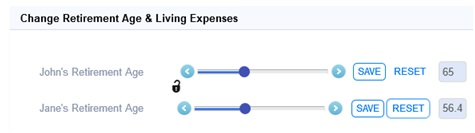

Consumers can now be do-it-yourselfers and empower themselves with their own financial and retirement planning. Instead of having to call up a financial advisor each time you want to run a what-if scenario, such as a new retirement date, you can do this yourself any time you like. Other scenarios many people are curious about are: what if there is a recession, what happens if my returns aren’t as rosy as projected, what if I save more money, and what if I move when I retire?

Instead of guessing when you might run out of money, accurate online financial and retirement planning software allows you to see your financial projections by year and to view, using Monte Carlo analysis, a probability of running out of money in the future.

Accounts All In One Place

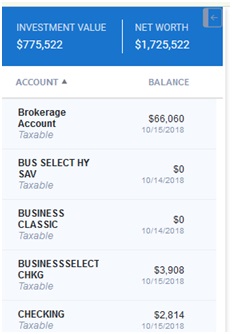

Not only has technology allowed consumers to be their own financial planner, it also allows us to aggregate and look at our financial accounts all in one location.

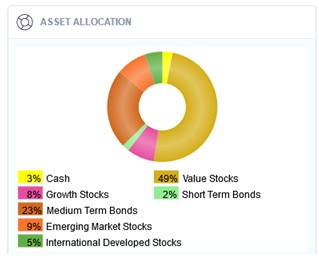

Instead of logging into multiple websites to view different investment assets, you can now look at all of your accounts in one location. You can also see your overall asset allocation with all assets aggregated together.

Historical Data And Fund Fees

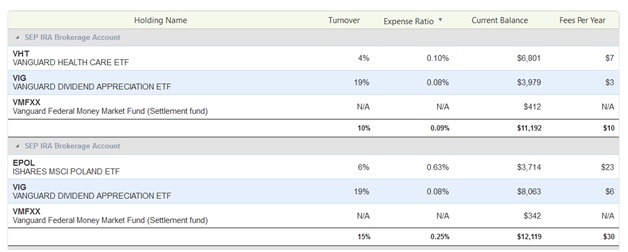

WealthTrace also allows you to view historical balances and transactions for all of your investment accounts. See when deposits come in and when checks go out. Check your dividend payments from your stocks and funds. View how your balances change over time. Perhaps even more important, you can see how much you pay in fees for all of the funds you own. Many people are surprised by how much their funds are charging them each year.

Sometimes it can be difficult to find the fee information online. Using WealthTrace you can easily view this important information and make more informed decisions.

Online Financial And Retirement Planning Is Easier Than Ever

Some people wait until they are 60 before they decide to figure out when they can actually retire. This is a big mistake. We should all have an idea of how much we should be saving to meet our retirement goals and we should know this early on.

The internet and associated technology have opened up a wealth of information for all of us. Whether it’s house shopping, job searches, or financial management, we can all take advantage of what the internet now has to offer.

So don’t pay thousands of dollars for a financial plan if you don’t have to. Empower yourself by using the tools that are on the web today. Not only can you plan for your financial future, but you can track exactly how you are doing each day.