Every individual wants to be the boss of their own. It is like a dream job for them. For many employees, remaining stuck with the 9 to 6 job is not the life they want. Their expectations are much more than what they are getting in the prevailing job. They want more flexibility, independence, and a desire to work with their own rules. To make all these things possible, self-employment is the right solution they think of.

Choosing to be self-employed, you are the builder of your own structure. It gives you complete freedom to set up the business the way you want. Think about the great example of Steve Jobs, who is known as an entrepreneurial legend. He has started his business in his parental garage, and now all of us are well-known with the firm called ‘Apple.’ For setting up that colossal name in the market, he has made considerable efforts and has gone through many ups and downs that lead him to success.

The central part of all the success stories relies on the term called ‘Finance.’ The more you take it into consideration, the better it will shape your business. The entire responsibilities lie on your shoulder. No doubt, as a self-employed individual, your focus will be on making your work more creative and compelling to expand your work with all the possible measures. But do not forget the money matter that can build the business and if not taken care of properly can break it.

Worrying about managing your finance? This article will help you out in identifying the best approaches as a self-employed person you can adopt to run your business without the fret of suffering from huge loss.

Ways To Manage Finance For Self-employment

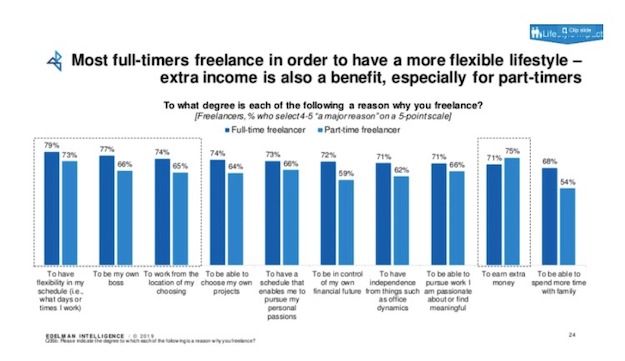

There is continuous emergence in the field of independent employment. About 76.01% portion is marketed by this category from total employment in India. A considerable population is thinking about this type of employment to gain all the flexibility and advantages that they may miss in the regular jobs. Let us better understand this by looking at the below statistic that shows how the freelancer, a type of self-employment, is opting for this professional-

Being a newly self-employed individual or an experienced one, money matters always remains a priority in business planning and execution. Here are a few ideas for overseeing your finance better that gives fruitful outcomes.

1. Budget Is The Core Processor

Like in any system without a proper central processor, the system can not work properly. Similarly, for running the business successfully, planning based on the prevailing budget is the prerequisite. Figure out an average income you get every month. As you are not working with a fixed salary base, there may be fluctuation in your income, but finding an average will help you in defining future expenses.

The budget will give you an idea about how to handle your personal expenses, funds for your business and helps to hold up money for any unexpected events. It will bring your attention to all the outlays and helps to complete them without missing any deadline.

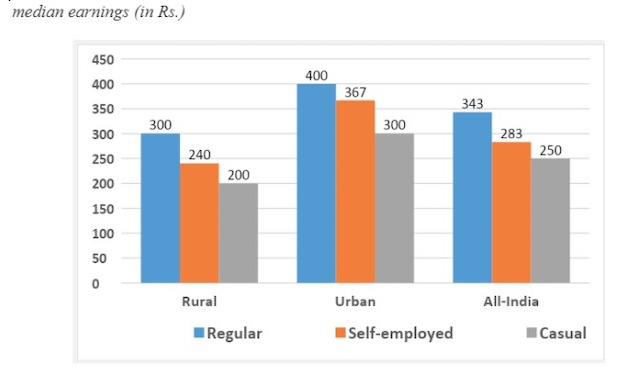

Self-employed individuals are making a huge contribution to all kinds of employment. To better understand this, look at the statistic shown below that depicts the median earning of various fields of employment.

With this statistic, it is clear that this field is on the great rise, and to be a good contributor in this journey, your first measurable step will be making a full-proof BUDGET.

2. Prioritize Tax Fund

The government has set aside regulations for all types of jobs for tax payment. Unlike the regular jobs that deduct the tax amount automatically and only after that deposits the salary. With this type of employment, sadly, such practice is not following. The responsibilities as a self-employed individual for tax planning lies on your shoulder.

Being the head of your own business, you have to take care of this aspect. You can take the help of any professional consultant that gives you a better idea about what rules you are abiding by and what the procedures are for paying the tax amount. It also helps in figure outing the period for payment. Based on that information, you can frame your expense chart keeping aside the money for tax.

Remember that missing it can bring many additional penalties that you need to suffer from, and the occasional occurrence of this event can cripple your business identity. Therefore, while budgeting, consider the portion of tax without fail.

3. Keep Track Of Your Expenses

If you are unknown with the fact that where you are spending your earnings, then how can you make a bright future. It is like the event where you have started your journey and are moving on a path without knowing where the destination lies. You are working in a field where the risk factor is more, and you are the only booster that can maximize the profit margin. Therefore, it is pretty necessary to keep an eye on every single money you spend.

Determining your expenses will help you in saving money from any unnecessary activities and also catches your attention towards the present working scenario. To take a step ahead in understanding this point, consider that you are developing a product. Your sole motto is to maximize its sale. But your major focus is taken in the development stage of the product and results in giving minimal attention for marketing it. Think will this bit part in hyping will reach the maximum audience? Surely your answer will be a big ‘NO.’

As a self-employed individual, you have to look for ideas that can bring fruitfulness and should not result in losing what you have gained. Keeping track of your expenditure is the right path that can lead you to develop successful projects from beginning to end that can boost your self-employed career in the proper direction. It will make your sights clear and will bend your efforts in an effective approach.

4. Make Retirement Plans

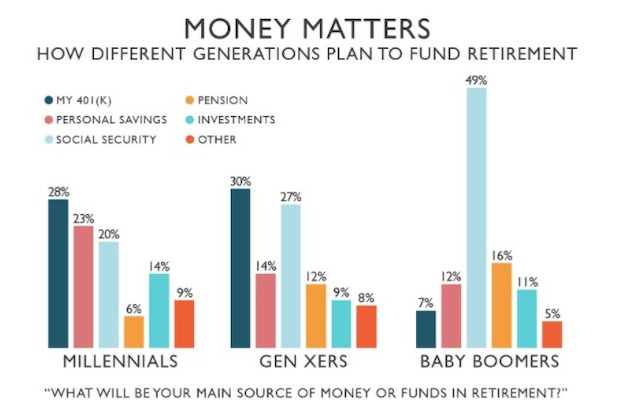

To be a self-employed professional, you are the caretaker of your present as well as future. Along with taking steps to make your present glorious, you also have to think about retirement plans. In everyone’s life, the retirement phase will surely come, and to successfully pass that phase, planning with little spending is the only required thing. But the thinking for the same differs as per the generation. To better look into it, refer to the figure as shown below-

Varieties of schemes and tools for retirement saving are available today, and you can choose the one that fits you the best. Consider this factor in your personal economics and do the funding for this aspect to make your retiral stage peaceful. Contributing a little will make a massive difference in the future. Therefore, there is nothing wrong to begin now and save money for the later stage of your life. Think adequately and develop strategies smartly to handle your life.

5. Give Yourself Salary

This title seems like giving a pat to yourself. But in a successful business plan, this element consists of significant importance. Being working on your own and maintaining all the expenses, you forgot to give the share to the one who is the largest contributor to this campaign. The one I am talking about is none other than your own self. Taking your share will save you from suffering from any financial consequences.

Adding to this, it also makes you stress-free to handle all your personal expenses that make your mental health stronger. It is one of the important tips as a self-employed individual you should consider. It also helps you to save money that can be useful in tough situations. Determine the respective amount that is enough for spending the month and pay that amount to yourself. If in a specific month you earn more, save that surplus amount and compensate for the period that has not remained that fruitful. You are the central hero of your game so never forget to consider yourself as the whole journey is for your better life and well-being. That’s why; give some time and importance to yourself that indeed help you in bettering your success journey.

period that has not remained that fruitful. You are the central hero of your game so never forget to consider yourself as the whole journey is for your better life and well-being. That’s why; give some time and importance to yourself that indeed help you in bettering your success journey.

6. Isolate Your Business And Personal Finances

Being the owner of your workplace, you can design it as per your convenience and requirement. Can you do your personal and professional work together? By using one hand for your business task, say client call, and the other one for handling your family activities. Absolutely not. The only thing that is performing both jobs together will bring is complete devastation. That’s why while designing your work area, build an imaginary wall that separates out the business and personal life.

A similar concept is applicable for managing your finances if you amalgamate both aspects of your life, how you will be able to grow your business. Keeping different accounts for personal and business activities is the first stage to track easily and scrutinize the records of the income and the related expenses.

Along with maintaining records, you can easily examine the expense and income graph of your business. It will give you an explicit idea about how your growth rate is moving. It makes the process of handling the financial affairs a bit easier and demands less time to look into the whole month’s money activities.

In a Nutshell

A self-employed role demands many identities to get played by a single individual. But among those important roles and duties, the one that is the most crucial job is to look for financial management because it has the power to set up the business and can even shut it down. Knowing how and where your money is going and taking the necessary steps to handle the financial affairs smartly will lead to giving all the advantages you want as a self-employed individual.