Tobacco is not only a health hazard but also affects your health insurance plans in terms of premiums paid. Even in case of term insurance plans, premiums paid by smokers is higher than that paid by non-smokers. In today’s world of inflated medical costs, availing health insurance plans is a necessity for every individual. It helps avoid heavy out-of-pocket medical expenses towards diseases of all kinds.

Having a medical insurance plan also ensures that you have a financial cushion to face serious diseases such as cancer, which would otherwise affect other financial goals such as your child’s higher education, or your retirement. However, being a smoker would have a significant impact on your health insurance policy.

Smoking has multiple health implications. Smoking not only impacts your lungs, it also increases the likelihood of you developing a host of other diseases. A smoker is at risk of diseases such as high blood pressure, several kinds of heart ailments, chronic obstructive pulmonary disease, severe bronchitis, osteoporosis, stroke and lung cancer.

This increases the risk undertaken by your insurer in order to provide you with a medical cover. Consequently, the premium you will need to pay will be higher than that paid by non-smokers of your age group and of similar profile.

Don’t Miss –

How Medical Billing Services Secure Patient’s Data with Cloud Faxing?

How is Technological Advancement Benefitting People’s Health?

Effect of smoking on health insurance premiums

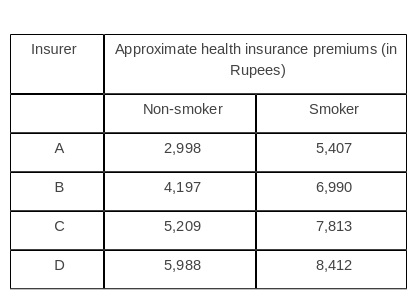

A quick survey of different medical insurance providers reveal how premiums charged vary from smokers to non-smokers. Here is a brief chart of the findings using premium calculators available online. The approximate figures provided in the chart below have been obtained upon calculating premiums for a 32-year-old male looking for a coverage of Rs.50 lakh.

What to do in order to lower premiums?

It is true that you will have to pay higher premiums towards your health insurance plans as a smoker. However, shying away from opting for medical insurance because of smoking is not a financially viable long-term plan. It may result in burning a hole in your pocket at a later stage in life due to a life-threatening disease when you are least prepared for it.

Instead, you can opt for one of the following ways to lower your policy premiums to an extent:

● Opt for health insurance while you are young. In that case you will be paying relatively lower premium.

● Try to eventually quit smoking. This will not only be conducive towards good health, but also affect your health insurance premiums in a positive way in the long run.

● Insurers do not distinguish between occasional and regular smokers. Even consuming an alternative form of nicotine will entail you to a higher premium. It’s best to stay away from all forms of nicotine for at least a year.

With health care costs rising every year, the better you take care of your health, the more money you save. The sooner you opt for health insurance plans, the better, as a medical emergency can strike at any time without prior warning. A medical cover will provide you with much needed financial cushion for such situations.

Availing financing for various large expenses is now easy with pre-approved offers from Bajaj Finserv. Whether you are looking for a home loan, a business loan or a personal loan for medical emergencies, all you need to do is to enter a few details to know your pre-approved offer.